Understanding Property Taxes in Mississauga

Your Comprehensive Guide

Welcome to our complete guide on Mississauga property taxes—a must-read for local homeowners and prospective buyers. Whether you’re new to the market or simply managing your property expenses, understanding these taxes can help you budget effectively and appreciate the services they finance.

What Are Property Taxes in Mississauga?

- Roads and public transit

- Waste management

- Parks and recreational facilities

- Community programs

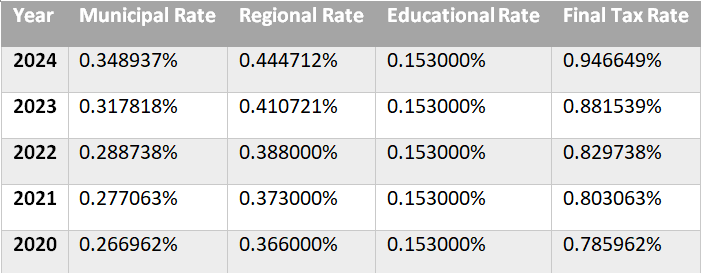

Decoding Mississauga Property Tax Rates

How to Calculate Your Property Tax

- $600,000 × 0.00946649 ≈ $5,680

- Interim Bills:

- Distributed in early February based on 50% of the previous year’s tax amount.

- Generally payable in three installments.

- Final Bills:

- Issued in early June reflecting the remaining balance after any rate adjustments.

- Residential properties also pay final bills in three installments; non-residential properties typically use a single installment.

- Pre-Authorized Tax Payment (PTP) Plan: Automatic monthly withdrawals with online enrollment.

- Online Banking: Payments made directly through your financial institution’s portal using your property tax roll number.

- Credit Card: Through third-party services like PaySimply (fees may apply).

- In-Person Payments: At local banks or drop boxes located at the Mississauga Civic Centre (cheques only).

- Mail: Send cheques with your roll number to: Mississauga Taxes, PO Box 3040, Station A, Mississauga, ON L5A 3S4.

Managing Your Taxes with Digital Tools

- eBill Registration:

- Access your bills online using your Tax PIN and property details.

- Property Tax Lookup:

- View basic tax information using your address or tax roll number without the need for a login.

Property Taxes by Property Type

Property tax implications in Mississauga differ notably based on the type of property you own. Here’s a breakdown of how taxes typically vary by property class:

- Detached Homes:

Detached homes usually carry the highest assessed values due to their larger size and land area. As a result, they tend to incur higher property taxes. - Semi-Detached Homes:

These properties often have slightly lower assessed values compared to detached homes, leading to moderately lower tax bills while still offering similar benefits. - Freehold Townhouses:

With freehold townhouses, the owner holds title to both the townhouse unit and the land it occupies. As such, property taxes are calculated on the entire value of the property. - Condo Townhouses:

Condo townhouses differ in that the homeowner typically owns only the interior space of the unit. The common areas and land are collectively owned and managed by a condominium board. Consequently, property taxes are assessed solely on the unit, while separate condo fees cover the maintenance of shared spaces. - Condos:

Standalone condominiums usually have lower assessed values than detached homes because only the interior living space is taxed. However, condo owners pay monthly fees to cover maintenance and common area expenses, which are an additional cost to consider alongside property taxes.

Conclusion: Empowering Your Homeownership Journey

Choosing the best educational environment for your child is both an academic and emotional investment. Whether you’re a long-time resident or a newcomer navigating Canada’s housing and education market—as I once did every step of the way—each choice carries its own unique challenges and rewards. By considering detailed school rankings, diverse specialized programs (including IB, AP, and Gifted Programs) and local market trends, you can make a decision that perfectly aligns with your family’s needs.

If you’re feeling overwhelmed or would appreciate personalized advice on navigating Mississauga’s educational landscape, we invite you to connect with us. Let’s work together to ensure your school search becomes a confident, informed journey.

Disclaimer:

This blog post provides general information and should not be considered financial or legal advice. Property tax rates and regulations are subject to change. Always consult the City of Mississauga and relevant professionals for the most current information.

Last Updated: May 2025

Want More Insights?

Related Blogs

FIND US

© MI REALTY. ALL RIGHTS RESERVED.